Characterizing Optimal Adword Auctions

Abstract

Section titled “Abstract”We present a number of models for the adword auctions used for pricing advertising slots on search engines such as Google, Yahoo! etc. We begin with a general problem formulation which allows the privately known valuation per click to be a function of both the identity of the advertiser and the slot. We present a compact characterization of the set of all deterministic incentive compatible direct mechanisms for this model. This new characterization allows us to conclude that there are incentive compatible mechanisms for this auction with a multidimensional type-space that are not affine maximizers. Next, we discuss two interesting special cases: slot independent valuation and slot independent valuation up to a privately known slot and zero thereafter. For both of these special cases, we characterize revenue maximizing and efficiency maximizing mechanisms and show that these mechanisms can be computed with a worst case computational complexity and respectively, where n is number of bidders and m is number of slots. Next, we characterize optimal rank based allocation rules and propose a new mechanism that we call the customized rank based allocation. We report the results of a numerical study that compare the revenue and efficiency of the proposed mechanisms. The numerical results suggest that customized rank-based allocation rule is significantly superior to the rank-based allocation rules.

Keywords: Pay-per-click adword Auctions, Dominant Strategy Equilibrium, Assignment Problem.

1 Introduction

Section titled “1 Introduction”Sponsored search advertising is a major source of revenue for internet search engines. Close to 98% of Google’s total revenue of $6 billion for the year 2005 came from sponsored search advertisements. It is believed that more than 50% of Yahoo!‘s revenue of $5.26 billion was from sponsored search

advertisement. Sponsored search advertisements work as follows. A user queries a certain adword, i.e. a keyword relevant for advertisement, on an online search engine. The search engine returns the links to the most “relevant” webpages and, in addition, displays certain number of relevant sponsored links in certain fixed “slots” on the result page. For example, when we search for “Delhi” on Google, in addition to the most relevant webpages, eight sponsored links are also displayed which include links to websites of the hotels in Delhi. Every time the user clicks on any of these sponsored links, she is taken to the website of the advertiser sponsoring the link and the search engine receives certain price per click from the advertiser. It is reasonable to expect that, all things being equal, a user is more likely click on the link that is placed in a slot that is easily visible on the page. In any case, the click likelihood is a function of the slot, and therefore, advertisers have a preference over which slot carries their link and are willing to pay a higher price per click when placed on a more desirable slot. The chance that a user clicks on a sponsored link is likely to be an increasing function of the exogenous brand values of the advertisers; therefore, search engines prefer allocating more desirable slots to advertisers with higher exogenous brand value. In conclusion, the search engines need a mechanism for allocating slots to advertisers. Since auctions are very effective mechanisms for revenue generation and efficient allocation, they have become the mechanism of choice for assigning sponsored links to advertising slots.

Adwords auctions are dynamic in nature – the advertisers are allowed to change their bids quite frequently. In this paper, we design and analyze static models for adword auctions. We use the dominant strategy solution concept in order to ensure that the static model adequately approximates dynamic adword auctions. The main contributions of this paper are as follows.

- (a) We formulate a general model for “pay-per-click” adword auctions when the privately known valuation-per-click vij of advertiser i is a function of the allocated slot j. Thus, the advertisers have a multi-dimensional type-space. We characterize the set of all dominant strategy incentive compatible, individually rational allocation rules. Using this characterization, we show that there exist incentive compatible allocation rules that are not affine maximizers (see Example 1). For details see §2.

- (b) When private valuation-per-click vij is not a function of the slot j, we completely solve the mechanism design problem, i.e. we characterize of the set of all dominant strategy incentive compatible, individually rational allocation rules, the unique prices that implements these rules, and the revenue maximizing mechanism and a computationally tractable implementation.

For this model, we analyze rank-based allocations rules and show how to compute an optimal rank based allocation rule. We show that even when the click-through-rate matrix is separable, i.e. cij is of the form cij = φiµj , the efficiency maximizing rank vector and revenue maximizing rank vector are not same, moreover, the unconstrained revenue maximizing mechanism is em not rank based (see Example 2).

We also propose a new, easy to implement allocation rule that we call the customized rank based allocation rule. We show that the this new rule has significantly superior performance – both in terms of efficiency and revenue – when compared with rank based mechanisms. For details see § 3.

(c) We analyze a model in which the valuations are privately known constant up to a privately known slot and zero thereafter, henceforth called the slotted valuation model. We present two suboptimal (revenue maximizing) mechanisms for this model, which perform remarkably well on a set of synthetic data. See § 4 for details.

(d) We implement all the proposed mechanisms and test their relative performance on a set of synthetic data. See § 5.

Our models are still far from capturing all the important tradeoffs in the current business models for adword pricing. In particular, we don’t model the influence of budgets, risk averseness, bidder irrationality (or bounded rationality) and diversification across adwords. There is growing literature which focus on these aspects on adword auctions, some of which we discuss in our literature survey.

The paper is organized as follows. We discuss the relevant literature in 1.1. In 2 we describe the general adword auction model. In 3 we discuss the adword auction model with slot independent private valuations. In 4 we propose and analyze the slotted model. In 5 we discuss the results of a preliminary numerical study and 6 contains some concluding remarks.

1.1 Previous Literature

Section titled “1.1 Previous Literature”The online adword auctions have caught the attention of the academic community only recently – after all, sponsored search and the Internet itself is a recent phenomena when compared with the long tradition of research in auction theory. The papers that specifically address adword auctions from the perspective of auction theory include Aggarwal et al. (2006b), Edelman et al. (2005) and Lahaie (2006). Edelman et al. (2005) present a comprehensive introduction and history of the adword auctions. Edelman et al. (2005) study an adword auction model with slot independent valuation, separable click-though-rate and generalized second price payment rule. They observe that truth-telling is not a dominant strategy for this auction. Aggarwal et al. (2006b) also study the same model and propose a payment rule under which any rank based allocation rule can be made dominant strategy incentive compatible. They also show that if the click-though-rate is separable (in which case the Vickery-Clark-Groves (VCG) allocation rule is rank based) there exists an ex-post equilibrium which results in same pointwise revenue as the generalized second price auction. This equilibrium is a simple adaptation of the equilibrium in Edelman et al. (2005). We demonstrate that this revenue equivalence follows in a straightforward manner from the fact that the private information in the uniform valuation model is single dimensional. Lahaie (2006) characterizes the equilibrium bidding strategies in rank based mechanisms with first price and second price payment schemes in both complete and incomplete information setting.

Varian (2006) characterizes the Nash Equilibrium in an adword auction with first price payments. In this model, the value per click only depends on the identity of the bidder and the click through rate only depends on the slot. Varian (2006) also reports results of comparing the prices predicted by the Nash equilibrium to empirical prices.

Zhan et al. (2005), Feng (2006a) and Lim and Tang (2004) present a Bayesian Nash analysis of a related adword auction model with one dimensional private information. Feng (2006b) studies bid price cycling in online auctions. Feng et al. (2005) assume truthful bidding and study the revenue performance of alternative rank based mechanisms using simulation. Liu and Chen (2005) propose using historical bid as the prior for designing the auctions. Kitts et al. (2005) present a simplified analysis of the equilibrium behavior with very few assumptions, focusing on dynamic behavior and empirical analysis of the bid data.

Shapley and Shubik (1972) describe an efficient assignment game in which bidders are assigned to objects with each bidder receiving at most one object. See Bikhchandani and Ostroy (2006) for a recent survey of mechanisms that yield efficient equilibria for the assignment game. Leonard (1983) showed that a specific optimal dual solution of the matching linear program implements the efficiency maximizing allocation in dominant strategy.

The characterization of the incentive compatibility constraint in the slotted model is based on Iyengar and Kumar (2006) where the authors study one-sided incentives in a reverse auction model. Vohra and Malakhov (2005) also consider a similar but restrictive model. We show in § 4 that this restrictive model is not adequate in the setting considered in this paper (see Example 3). Aggarwal et al. (2006a) propose a top-down auction for a slotted model with bidder independent click-through-rate and show that this auction has an envy-free Nash equilibrium with the same allocation and prices as the efficiency maximizing VCG mechanism. We show in § 3 that the top-down allocation rule is a special case of the customized rank-based allocation rule.

Notation

Section titled “Notation”We denote vectors by boldface lowercase letters, e.g. . A vector indexed by -i, (for example ) denotes the vector with the i-th component excluded. We use the convention . Scalar (resp. vector) functions are denoted by lowercase letters, e.g. (resp. ). The possible misreport of the true parameters are represented with a hat over the same variable, e.g. ). We will use the terms advertiser and bidder interchangeably.

2 Adword Auction Model

Section titled “2 Adword Auction Model”There are n advertisers bidding for slots on a specific adword. Let denote the click-through-rate when advertiser i is assigned to slot j. For convenience, we will set for all .

Assumption 1. The click through rates satisfy the following conditions.

- (i) For all bidders i, the rate strictly positive and non-increasing in j, i.e. all bidders rank the slots in the same order.

- (ii) The rates , for all (i,j) pairs are known to the auctioneer.

- (iii) Only the rates are known to bidder i, i.e. each bidder only knows her click-through-rates.

The true expected per-click-value of slot j to advertiser i is private information. We assume independent private values (IPV) setting with a commonly known prior distribution function that is continuously differentiable with density . Note that even through we use dominant strategy as the solution concept, we still need the prior distribution in order to select the optimal mechanism. We restrict attention to direct mechanisms – the revelation principle guarantees that this does not introduce any loss of generality.

Let denote the bids of the n bidders. An auction mechanism for this problem consists of the following two components.

- An allocation rule that satisfies

Thus, is a matching that matches bidders to slots as a function of the bid . Henceforth, we denote the set of all possible matchings of n advertisers to m slots by .

- A payment function that specifies what each of the n bidders pay the auctioneer.

We show below that one can set the payment of the bidder who is not allocated any slot to zero without any loss of generality. Thus, we can define the per click payment of advertiser i as

For and , let

(1)

denote the utility the advertiser i of type who bids . When the mechanism is clear by context, we will write the utility as .

We restrict attention to mechanisms that satisfy the following two properties:

- Incentive compatibility (IC): For all and all ,

(2)

i.e. truth telling is ex-post dominant.

- Individual rationality (IR): For all and all ,

\underset{\mathbf{b} \in \mathbb{R}_{+}^{m}}{\operatorname{argmax}} \left\{ u_{i}(\mathbf{b}; (\mathbf{X}, \mathbf{T}), \mathbf{v}_{-i}) \right\} \ge 0, \tag{3}

i.e. we implicitly assume that the outside alternative is worth zero.

Let

(4)

denote the maximum attainable utility for advertiser i under the mechanism . If the mechanism is IC and IR then clearly,

(5)

Next, we develop an alternative characterization of the IC constraint. Fix and consider the optimization problem of i-th bidder,

Clearly is convex in since it is a maximum of a collection of linear functions and by envelope conditions its gradient (under truth-telling) is given by

Thus, an incentive compatible allocation rule is always a sub-gradient of some convex function and hence integrable and monotone1, as was first observed by Rochet (1987).

Several authors have characterized the set of incentive compatible allocation rule in quasi-linear environments (see Lavi et al. (2004); Hongwei et al. (2004); Chung and Ely (2002); Saks and Yu (2005) ) in terms of the absence of negative 2-cycles (also called weak monotonicity):

i.e. the sum of utility allocated to advertiser i at and under truthful bidding is greater than the sum of utility allocated to advertiser i if he lies and bid at and at . For a convex domain this condition implies that the allocation is integrable and the transfer payments implementing are well defined. Chung and Ely (2002) propose a new implementability condition called quasi-efficiency according to which an allocation rule is IC if, and only if, for all , there exist functions such that

where is the private information and is the set of allocations. For efficient allocations, the functions is just the sum of utilities of all bidders other than i at their respective type .

One drawback of these characterizations is that they guarantee existence of transfer payments but do not provide any way of computing them. We give a new characterization of IC allocation rules directly in terms of bidder dependent slot prices.

Lemma 1. An allocation rule is incentive compatible if and only if for all and , there exists per-click prices and such that,

Proof: Fix i, and suppress the dependence on . is IC iff there exists convex functions (i.e. the indirect utilities) such that

for some a.e.

The function is monotone if for every ,

where is the j-th unit vector, and . Since a convex function is absolutely continuous, it follows that is piecewise linear. Furthermore, a piecewise linear function is convex if, and only if, it is the pointwise maximum of each of its pieces; thus,

(6)

Define

Recall that . We claim that for all , i.e. the payment for bidder i does not change with her bid as long as she gets the same slot2. Suppose this is not the case and there exists such that . Then the bidder with valuations would lie and bid . Thus,

\tag{7}

Comparing (6) and (7), and noting that iff , we get and

where we set for notational ease. This establishes the result.

Since is the surplus of bidder i when she is not assigned any slot, IR implies that . For any given IC and IR mechanism and a fixed , let then also satisfies IC. To see that satisfies IR, let . Then

implying . Since the auctioneer would always like to minimize the bidder surplus, in the remainder of the paper, we will assume that all the prices are restricted to be positive and is set to 0.

The above lemma can be interpreted as follows. An allocation rule, X is IC if, and only if, there exist bidder-dependent slot prices such that bidders self-select the slot allocated to them by X. Thus, any deterministic incentively compatible mechanism is uniquely identified by the pricing rules .

To further understand the relationship between the characterization in Lemma 1 and integrability and monotonicity of the IC allocation rule. Fix . Lemma 1 implies an allocation rule is IC if and only if the following two conditions are satisfied.

(1) If we increase , keeping the rest of the component of constant, there exist a threshold value such that for all , advertiser i is not allocated a slot j and for all advertiser i is allocated slot j.

<sup>2This claim has been observed in several previous works in more general settings.

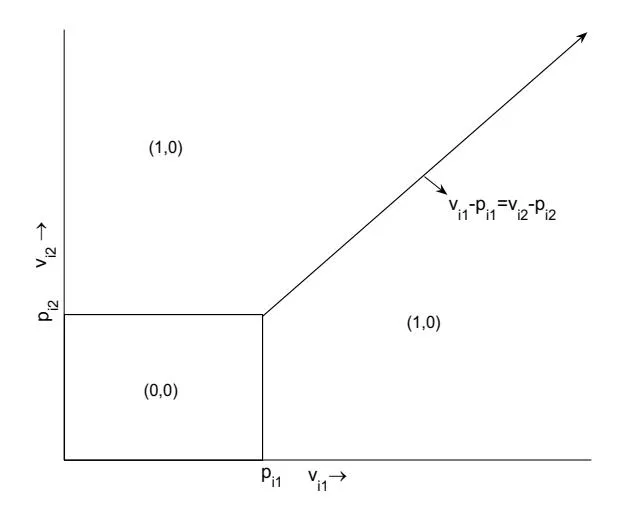

Figure 1: IC Allocation Rules

(2) The normal to the hyperplane separating the region in which advertiser i is allocated slot j (i.e. Sj ) and the region in which advertiser i allocated slot k (i.e. Sk) is parallel to (0, … , cij , … , −cik, … , 0).

Condition (1) implies monotonicity of X, i.e. the convexity of the surplus function, and condition (2) implies integrability of X. Figure 1 illustrates the above conditions when there are only two advertising slots. For fixed v−i , there exist pi1 ≥ 0 and pi2 ≥ 0 such that

2.1 Social surplus maximization

Section titled “2.1 Social surplus maximization”It is well known that truth telling can be implemented in dominant strategies by the Vickery-Clark-Groves (VCG) mechanism (Groves (1979)) using the allocation rule Xe that maximizes the social surplus

(8)

It is also well known that the linear programming (LP) relaxation of (8) obtained by relaxing the constraint Xij ∈ {0, 1} to Xij ∈ [0, 1] is equivalent to a maximum weight flow problem on bipartite graph with unit capacities. For any such network flow problem, there exists an optimal flow that takes values in the set {0, 1}, i.e. the flow is optimal for (8), and can be computed O(nm2 ) time (see, e.g. Ahuja et al. (1993)).

Let

(9)

denote the per-click VCG prices. For , let denote the index of the bidder assigned to slot j, i.e. . Leonard (1983) established that the vector of slot prices , are the unique optimal solution of the LP

Since is a piecewise constant function of and given , is a piecewise linear function of , it follows that the per-click VCG price is a piecewise linear function of .

Let

i.e. denotes the maximum achievable social surplus excluding the bidder i and the slot j. Then the bidder dependent slot prices defined in Lemma 1 are given by

p_{ij}(\mathbf{v}_{-i}) = \frac{1}{c_{ij}} \left( \Phi(\mathbf{v}_{-i}, n-1) - \tilde{\Phi}_j(\mathbf{v}_{-i}) \right). \tag{10}

It is easy to check that if bidder i is assigned slot j in , the price . From (10) it is clear that the prices are piece-wise linear functions of . These prices can be efficiently computed by solving the two optimal weighted matching problems.

2.2 Revenue maximization

Section titled “2.2 Revenue maximization”We first consider the case n=1. This corresponds to monopoly pricing of stationary advertisement, e.g. lease pricing of slots on the public webpages. It follows from Lemma 1 that a revenue maximizing mechanism for a risk-neutral auctioneer is to allow the bidders to self-select slots based on the posted slot prices

\mathbf{p}^* \in \underset{\mathbf{p} \in \mathbb{R}_+^m}{\operatorname{argmax}} \sum_{j=1}^m p_j c_j \mathbb{E} \Big[ \mathbf{1} \Big( j \in \underset{1 \le k \le m}{\operatorname{argmax}} \{ c_k (v_k - p_k) \}, v_j \ge p_j \Big) \Big], \tag{11}

where denotes the expectation with respect to the prior distribution of the valuation vector .

For n > 1, the optimal revenue optimizing mechanism is the solution of the stochastic optimization problem

s.t. a.s. (12)

The stochastic optimization problem (12) is likely to be computationally hard and very sensitive to the prior distribution. See Rochet and Chone (1998) for a general treatment of the mechanism design problem with multidimensional type.

2.3 Affine maximizers vs general pricing rules

Section titled “2.3 Affine maximizers vs general pricing rules”In this section we relate the bidder-dependent per-click slot prices to prices implied by allocation rules that maximize an affine function of the bidder surplus.

In our setting, a mechanism (X(v), T(v)) is called an affine maximizer auction if there exists constants {wij} and {rij} such that X(v) maximizes

and the payment T w,r i (v) when bidder i is assigned to slot j is given by

The constants {rij} can be interpreted as bidder-dependent slot reservation prices. The affine maximizer allocation rule X(v) also corresponds to an optimal flow in an appropriately defined network flow problem and the payments T(v) correspond to an appropriately defined minimal dual optimal vector.

The bidder-dependent slot prices pij (v−i) that implement the affine-maximizer allocation rule are given by

where

Since Φw,r(v−i , n − 1) and Φ˜ w,r j (v−i) are piece-wise linear, the prices pij (v−i) are piecewise linear functions of v.

Roberts (1979) showed that in a quasi-linear preference domain for a large enough type space (in particular, when the type space is R |A| where A is the allocation space) affine maximizers are the only dominant strategy implementable allocation rules. Given this result, a natural question that arises is whether there exist IC allocation rules in a quasi-linear environment with a given type space that are not affine-maximizers. Lavi et al. (2004) raise this question for a matching problem which does not satisfy the conflicting preferences constraint (see Open Problem 2, page 36). Since Lemma 1 does not restrict the bidder-dependent prices pi(v−i) to be of a particular form, whereas the bidder-dependent prices corresponding to affine-maximizers are piecewise linear function of v, there is a possibility that affine-maximizers are a strict subset of IC allocation rules.

Example 1. Consider an adword auction with two slots and two bidders. Let X(v) denote the allocation rule that allocates slot 1 to bidder 1 if, and only if,

for some 0 < γ < 1 and to bidder 2 otherwise, and assigns slot 2 to the unassigned bidder.

It is easy to check that this allocation rule is IC with prices

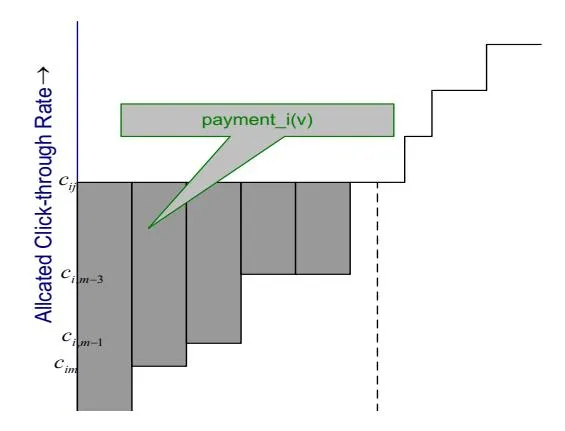

Figure 2: Incentive Compatibility: Allocated click-though-rate as a function of valuation

where the last expression follows from the fact that slot 1 is assigned to bidder 2 whenever .

The prices are strictly non-linear functions of . Consequently, is an IC allocation rule that is not an affine maximizer.

We conclude this section with the following theorem.

Theorem 1. There exist individually rational and incentive compatible deterministic direct mechanism which are not affine maximizers.

3 Slot independent valuations

Section titled “3 Slot independent valuations”In this section, we consider the special case where the true per-click valuations of all the bidders are slot independent, i.e. for all i = 1, …, n, j = 1, …, m. Thus, the type-space of the bidders is single-dimensional.

3.1 Incentive compatible mechanisms

Section titled “3.1 Incentive compatible mechanisms”Lemma 2. The following are equivalent characterizations of IC allocation rules.

- (a) The click-through-rate is non-decreasing in for all fixed .

- (b) For all i and there exist thresholds such that bidder i is assigned slot j iff .

- (c) For all i and , there exist slot prices of the form

p_{ij}(\mathbf{v}_{-i}) = \frac{1}{c_{ij}} \sum_{k=i}^{m} \left( a_{ik}(\mathbf{v}_{-i}) - a_{i,k+1}(\mathbf{v}_{-i}) \right) (c_{ij} - c_{i,k+1}), \tag{13}

where such that bidders self select the slot assigned to them.

Proof: Part (a) follows immediately from Holmstrom’s Lemma (see, p.70 in Milgrom (2004)).

Since and by Assumption 1(i) the total click-through-rate is non-decreasing with if, and only if, there exist thresholds such that the allocation rule allocates slot j to advertiser i iff . This is illustrated in Figure 2.

It is easy to check that prices of the form (13) results in bidder i self-selecting slot j if the valuation . Thus, part (b) implies that the prices result in an IC allocation rule.

To prove the converse, observe that the payment under any IC allocation rule X must be of the form

It is easy to check that is equal to the area of the shaded region in Figure 2. Thus per-click price for slot j = 1, …, m,

where we have set for all i = 1, …, n.

Note that by interchanging the order of integration, i.e. by computing the area of “horizontal” rectangles in Figure 2, the prices can be alternatively written as

(14)

3.2 Revenue maximization

Section titled “3.2 Revenue maximization”From Myerson (1981), it follows that expected revenue of the auctioneer under any dominant strategy incentive compatible allocation rule X is given by

where is the prior density of , i = 1, …, n. Thus, any two mechanisms (direct or indirect) which at a dominant strategy equilibrium agree on the point wise assignment for every and on the equilibrium utilities for all result in identical expected

revenues. Aggarwal et al. (2006b); Edelman et al. (2005) explicitly construct one equilibrium for the generalized second price auction which results in same pointwise revenue as the truth-telling equilibrium in the direct mechanism.

Let

Suppose the virtual valuations per click are non-decreasing. Then the allocation rule results in a non-decreasing total-click-through for each of the bidders. Hence, part (a) in Lemma 2 implies that is IC. Since the pointwise maximum is an upper bound on any expected revenue maximizing allocation, is expected revenue maximizing, dominant strategy IC, IR rational allocation rule with per-click prices given by (13). When the virtual valuations are non-monotonic, the revenue maximizing mechanism can be constructed by first ironing (see Myerson (1981)) the virtual valuation to obtain a non-decreasing virtual valuations and then using the construction above.

In the rest of this section, we show how to efficiently compute the payments, or equivalently, thresholds corresponding to the rule . Consider the allocation rules of the form,

for any set of , and non-decreasing. We call monotone maximizer with respect to the set of monotone transformations . Given can computed efficiently in time as a solution to optimal weighted matching problem. It is straight forward to observe that is incentive compatible and hence has the form presented in Figure 2.

As a first step towards computing the slot prices that implement the allocation rule we solve the parametric assignment problem

\max_{\mathbf{X} \in \mathcal{M}_{nm}} \left\{ \lambda \sum_{j=1}^{m} c_{i_0 j} X_{i_0 j} + \sum_{k=1, k \neq i}^{n} \sum_{j=1}^{m} v_k c_{k j} X_{k j} \right\},\tag{15}

where is the parameter. It is clear that (15) is equivalent to the parametric minimum cost network flow problem

minimize subject to

on a graph defined as follows.

- (i) has one node for every bidder and slot, and one additional node s.

- (ii) has unit capacity directed arcs from each bidder to each slot l with cost and from s to each bidder with cost zero.

Algorithm 1 OptMatch

Section titled “Algorithm 1 OptMatch (i0,v−i0,c)(i_0, \mathbf{v}_{-i_0}, c)(i0,v−i0,c)”- 1: , .

- 2: Solver optimal matching problem at .

- 3:

- 4: while do

- 5: optimal node potentials at tree T for and arc costs equal to zero for all arcs (k, l) with and .

- 6: optimal node potentials at tree T for and

- 7:

- 8: the edge achieving the minimum in the previous step.

- 9:

- 10: Perform a network-simplex pivot with as the entering arc.

- 11:

- 12: end while

- (iii) has unit capacity directed arcs from bidder i to each slot j with cost .

- (iv) Each of the slots has unit demand and the node s has a supply of m units.

Lemma 3. OptMatch correctly computes the thresholds that which bidder is assigned to slot j = 1, …, m, and the worst case running time of the algorithm is .

Proof: Given a spanning tree structure , the node potential corresponding to the parameter value is given by with and as computed in step 5 and 6. At each optimal spanning tree structure, the non-negativity of reduced costs for each parametric edge gives a bound on as follows:

Since for each non-parametric edge (k, j), the reduced cost of non-parametric edges, is positive for all values of greater than the current . Thus, the threshold on up to which the current spanning tree structure remains optimal is equal to the minimum of the upper bounds in (17).

After the initial solution, the algorithm performs at most m pivots each costing , each returning a threshold at which advertiser i can be assigned slot j. Thus, the overall complexity of OPTMATCH is .

This proof is adapted from the solution of exercise 11.48 in Ahuja et al. (1993).

Next we use OPTMATCH to compute slot prices implementing the monotone maximizer allocation .

Algorithm 2 ComputePrices

Section titled “Algorithm 2 ComputePrices”1: \mathbf{z} \leftarrow (\psi_1(v_1), \dots, \psi_n(v_n)), c_{i,m+1} \leftarrow 0, a_{i,m+1} \leftarrow 0 2: \mathbf{for} \ \mathbf{i} = 1 \ \mathbf{to} \ \mathbf{n} \ \mathbf{do} \tilde{\mathbf{a}} \leftarrow \text{OPTMATCH}(i, \mathbf{z}_{-i}, \mathbf{c}). for j = 1 to m do 4: a_{ij} \leftarrow \psi_i^{-1}(\tilde{a}_{ij}) 5: if a_{ij} = \infty then 6: a_{ij} \leftarrow \min_{j < k \le m} a_{ik} 7: end if 8: end for 9: for j=1 to m do10: p_{ij} \leftarrow \frac{1}{c_{ij}} \sum_{k=j}^{m} (a_{ik} - a_{i,k+1})(c_{ij} - c_{i,k+1})11:12:13: end forLemma 4. Algorithm Compute Prices correctly computes the prices implementing in time.

Proof: Without loss of generality, consider the computations for bidder 1. The call to the OPT-MATCH returns the thresholds at which bidder 1 get slot j in the virtual valuation space. By the monotonicity3 of , is the corresponding threshold in v-space. Step 6-8 in the algorithm check for the condition that a slot p is never allocated to bidder 1 but a more desirable slot k < p is allocated at and, in that case, set (This convention is implied in (13)). Step 10-12 use (13) to compute the prices given the thresholds.

The dominating computation inside the FOR loops is the call to OPTMATCH, thus giving a time complexity.

The payment corresponding to the revenue maximizing allocation rule can be computed efficiently using the Lemma 4 with .

3.3 Rank based allocation rules

Section titled “3.3 Rank based allocation rules”Definition 1 (Rank based allocation rule). A rank based allocation rule with rank vector allocates slot j to the bidder in the position in the decreasing order statistics of , where is the vector of advertiser’s bid.

Let denote the rank based allocation rule with ranking vector . Let . Then under , the total click-through rate for bidder i is given by

where denotes the j-th largest term in the vector and denotes the indicator function that takes the value 1 when its argument is true, and zero otherwise. Since is increasing in

<sup>3If is flat in some interval is taken to right continuous at the point of discontinuity.

and , it follows that the total click-through rate is non-decreasing in . Thus, by Lemma 2 part(a), is incentive compatible.

Lemma 5. The unique per click price , implementing the rank based allocation rule, are given by,

(18)

Proof: Fix . The rank based allocation rule with ranking vector allocates slot j to advertiser i iff . Thus, the thresholds (see Lemma 2, part (b)) are equal to . Thus (18) follows from the alternative characterization of per click prices in Lemma 2, part (c).

Aggarwal et al. (2006b) computes (18) using arguments especially tailored for rank based allocations.

The simplicity of the rank based mechanisms make them a very attractive. However, which rank vector to use is far from clear! In particular, if the click-though-rate is not separable, i.e. , then both the Google rank vector and the Yahoo! rank vector neither maximize efficiency nor maximize revenue. We show that even when the click-through-rate is separable the revenue maximizing rank vector is not the same as the efficiency maximizing rank vector and the revenue maximizing mechanism is not rank-based!

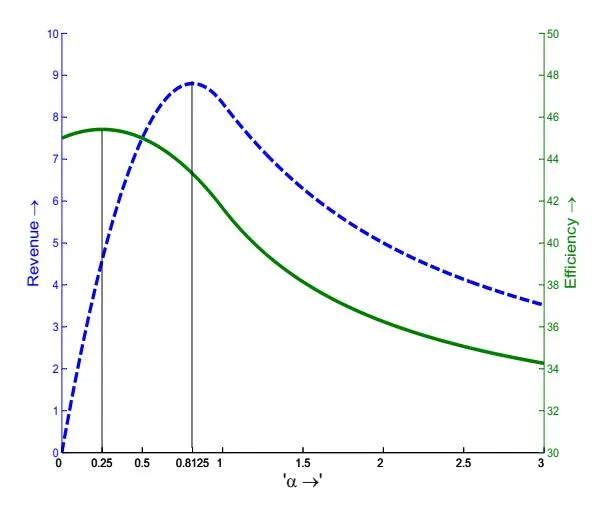

Example 2. Consider an adword auction of two slots and two bidders with valuations, uniformly distributed on [0,1]. Suppose a rank based auction mechanism awards the slot 1 to advertiser 1 if and to merchant 2 otherwise. Define and . Then the prices in (18) imply that the expected revenue of the auctioneer,

Simplifying, we get

Thus the optimum4,

Similar calculation for efficiency shows that the expected social surplus is given by,

and the efficiency maximizing rank vector . Thus, .

The optimal point can be graphically verified to be unique. For , is concave and for , even though neither convex nor concave, monotonically increases up to a constant and decreases thereafter.

Figure 3: Revenue and efficiency as a function of in Example 2

Now, assume that the click-through-rate is separable, , for and . Then the revenue maximizing rank vector

and the efficiency maximizing rank vector . Since are uniformly distributed on [0,1], the virtual valuations , and the revenue maximizing allocation

Thus, assigns slot 1 to bidder 1 if and to bidder 2 otherwise. This is not a rank based allocation even though the click-through-rate is separable! The efficiency maximizing allocation rule is clearly rank based with .

Figure 3 plots the efficiency and revenue as a function of for . For this data, and . The efficiency maximizing ranking vector being more biased than the revenue maximizing vector because even though bidder 2 generates more value in slot 2, bidder 1 determine the slot price.

We propose customized rank based allocation rule as an improvement over the rank based allocation rule. This rule reduces to the top down auction proposed in Aggarwal et al. (2006a) when , i.e. bidder independent click-through-rates.

Definition 2 (Customized Rank Based Allocation). A customized rank based (CRB) allocation rule allocates slot j to the bidder having highest order statistics of among those who have not been assigned a slot < j.

Algorithm 3 COMPUTECRPRICES

Section titled “Algorithm 3 COMPUTECRPRICES”for i=1 to n do \mathbf{S} \leftarrow \phi, \, \mathbf{N}_i \leftarrow \{1,\dots,n\} \setminus \{i\}, j \leftarrow 1, c_{i,m+1} \leftarrow 0, a_{i,m+1} \leftarrow 0. for j=1 to m do (s,I) \leftarrow \max_{k \in \mathbf{N}_i \setminus \mathbf{S}} (\{c_{kj}v_i\}). a_{ij} \leftarrow \frac{s}{c_{ij}}, \, \mathbf{S} \leftarrow \mathbf{S} \bigcup I end for \mathbf{for} \, j=1 \, \mathbf{to} \, m-1 \, \mathbf{do} if a_{ij} < a_{i,j+1} \, \mathbf{then} a_{i,j+1} \leftarrow a_{ij} end if end for \mathbf{for} \, j=1 \, \mathbf{to} \, \mathbf{m} \, \mathbf{do} p_{ij} \leftarrow \frac{1}{c_{ij}} \sum_{k=j}^{m} (a_{ik} - a_{i,k-1})(c_{ij} - c_{i,k-1}) end for end forUsing Lemma 2, it is straightforward to deduce that the CRB allocation is incentive compatible. Thus, the prices implementing CRB allocation rule satisfy (13). Algorithm ComputeCRBPRICES computes the prices implementing customized rank based allocation rule in time. Establishing correctness of the algorithm is straightforward and is left to the reader. Also, by using the virtual valuations,

instead of the valuations v in Algorithm ComputeCRBPrices, the customized rank based allocation rule can approximate revenue maximizing auction as well. In general, the CRB allocation rule is likely to out-perform any rank based allocation in terms of both efficiency and revenue generation.

3.4 Separable Click-though Rate

Section titled “3.4 Separable Click-though Rate”Suppose the click-through rate is separable, i.e. with and . In this setting, the following results immediately follow from our results in the previous section.

-

- The solution to the social (virtual) surplus maximization problem is rank based, i.e. the slot j is awarded to the order statistics of (respectively ).

-

- The price-per-click given by (9) implementing the efficiency maximizing allocation are given

by

(19)

- The price-per-click implementing revenue maximizing allocation rule is given by,

(20)

where and represent the and bid of advertiser ranked k.

When the click-through-rate is separable, CRB allocation rule is the same as the Google allocation rule with rank vector and is optimal for efficiency maximization.

4 Slotted Mechanism

Section titled “4 Slotted Mechanism”In this section, we consider the per click valuations of the following form

where the tuple is the private information (i.e. type) of the bidder i.

The efficiency maximization problem is given by

subject to (21)

Since the a bid is ex-post observable, the bidders are restricted to bid . Since advertisers have one-sided incentives about , this is not a standard mechanism design problem. However, the specific structure of the problem, namely that for all i, and , the total surplus is non-decreasing in , ensures incentive compatibility with respect to at the VCG payments. When are common knowledge, the solution presented in § 3 can be directly applied by pointwise maximizing the virtual surplus.

The following Lemma characterizes the set of all incentive compatible allocation rules in the slotted valuation model. The proof is a simple adaptation of the proof of Lemma 1 in Iyengar and Kumar (2006).

Lemma 6. The following are equivalent characterizations of IC allocation rules.

(a) The total click-through rate

for each bidder i is a non-decreasing function of b for all .

- (b) For all i, v−i and k, there exists thresholds 0 ≤ ai,m ≤ ai,m−1 ≤ · · · ≤ ai,ki ≤ ∞ such that bidder i is allocated slot j iff vi ∈ (aij , ai,j−1].

- (c) The utility of each bidder i under allocation rule X is of the form

where ui(ki ,(v−i , k−i)) are non-negative and nondecreasing functions of ki appropriately chosen to ensure that ui(vi , ki ; v−i , k−i) is non-decreasing in ki for all (v, k−i).

Lemma 6 part (a) and (c) implies that any feasible mechanism that is IC with respect to the valuation bid can be made IC with respect to the slot bid using independent side payments ui(ki ,(v−i , k−i)) so that the total surplus of each bidder is increasing with ki . In the rest of this section, the term nomimal surplus will denote the term

Lemma 6, together a change in the order of integration (see Iyengar and Kumar (2006), Theorem 1), implies that the revenue maximization problem is equivalent to choosing a feasible allocation rule X with Xij (v) = 0 for all ki < j ≤ m, 1 ≤ i ≤ n and a set of side payments ui that maximize

subject to the constraint that Pm j=1 cijXij (vi , v−i) is non-decreasing in vi for all i, v−i , k, and ui(ki , v−i) + R vi 0 Pm j=1 cijXij ((u, ki),(v−i , k−i)) du is non-decreasing with ki for all i, v, k−i .

Since the social surplus depends on ki , there exist bid profiles at which the total click through rate assigned to some bidder i is not monotone in ki . Hence, the nominal surplus,

(22)

is not monotone in ki . Consequently, there does not exist any regularity conditions on the prior distribution fi(vi , ki) that guarantees that the side payments ui can be set equal to zero without loss of generality. Example 3 presents a concrete example to demonstrate this.

Example 3. Let c = 3 0 3 1 , and the realized k1 = k2 = 2. Suppose vi and ki are independent. The nominal surplus, given by (22), of bidder 2

Thus, if are such that , bidder 2 prefers to bids . Suppose the realized , then bidder 2 strictly prefers to bid if . Suppose the CDF of is given by

i.e. a mixture of a uniform distribution on and an exponential distribution with rate on respectively. Then the corresponding virtual valuation function is

so that and . Thus for all bidder 2 strictly prefers to bid .

Consequently pointwise optimal solution with side payments set to zero does not induce truth-telling and, hence, is sub-optimal in this example.

Vohra and Malakhov (2005) only considers the IC mechanisms with . The above example shows that this constraint might eliminate a number of reasonable allocation rules.

Lemma 6 part(b) and a simple adaptation of Lemma 4 gives the following result.

Lemma 7. Given any set of , and non-decreasing, the nominal surplus,

can be computed in for any solution to (21) with replaced by .

The proof of this lemma is left to the reader.

Next, we discuss two heuristic mechanisms for maximizing revenue. The first heuristic mechanism is defined as follows. If there exists intervals over which the virtual valuations is increasing in , use the ironing procedure detailed in (section 3.2) Iyengar and Kumar (2006) to compute ironed out virtual valuation that is non-decreasing in . Set the allocation rule

\mathbf{X}(\mathbf{v}, \mathbf{k}) \in \operatorname{argmax} \sum_{i=1}^{n} \sum_{j=1}^{m} c_{ij} \hat{\nu}_i(v_i, k_i) X_{ij}(\mathbf{v}). \tag{23}

Since is non-decreasing in , is IC. Set the transfer payment

(24)

where

(25)

This payment ensures that the total surplus of each bidder i is non-decreasing in . Since side payments are identically zero in the VCG mechanism, it follows that the side payment above would be identically zero if the virtual valuation are replaced by valuation. Lemma 7 implies that this mechanism can be implemented in time.

Second mechanism is CRB as described in §3 applied to the slotted valuation model, i.e., for j = 1, …, m allocate the slot j to a bidder having highest order statistics of among those who have not been assigned a slot number less than j and who have .

Assume that for all i, , the virtual valuation function is non-decreasing in and . Since, for all i, and , the click-through-rate of the slot allocated to advertiser i is non-decreasing in , this mechanism is IC. Also note that for all i, , , the click-through-rate of the slot allocated to advertiser i is non-decreasing in , which implies that the nominal surplus, is non-decreasing in . Thus, we can set the side payments to be identically zero for this allocation rule, i.e. under , the advertisers does not earn any information rent due to the dimension of the bid. Moreover, algorithm ComputeCRBPRICES can be used times for each i to compute the prices that implement the slotted mechanism in time. The following lemma summarize the above results.

Lemma 8. If the virtual valuations , i = 1, …, n are non-decreasing in and then is incentive compatible with unique minimal prices and side payments identically set to zero. Furthermore, these prices can be computed in time.

Note that, given an IC allocation rule, X the nominal expected revenue,

(26)

is an upper bound on the optimal expected revenue achievable by . Since pointwise maximum defined in (23) is an upper bound on the optimal expected revenues, setting in (26) gives an upper bound on the achievable optimal expected revenue. We compare the relative performance of the two sub-optimal mechanisms proposed in the numerical study presented in the next section, which is remarkable for the synthetic data set used.

Finally, we remark that the problem of finding optimal mechanism is hard because we need to select both an allocation rule and a set of side payments independently. This is because the transfer payment implementing a given IC allocation rule is not uniquely defined by the rule. We conclude this section with the following result.

Lemma 9. Suppose the click-through-rates are separable. Then the CRB mechanism is optimal for social surplus maximization. When the virtual surplus is non-decreasing in both and , the CRB with is optimal for revenue maximization.

5 Comparing the mechanisms: a numerical study

Section titled “5 Comparing the mechanisms: a numerical study”In this section, we report the results of a numerical study that compares the revenue and efficiency properties of the RB and CRB mechanisms as compared to the optimal mechanisms in the slot

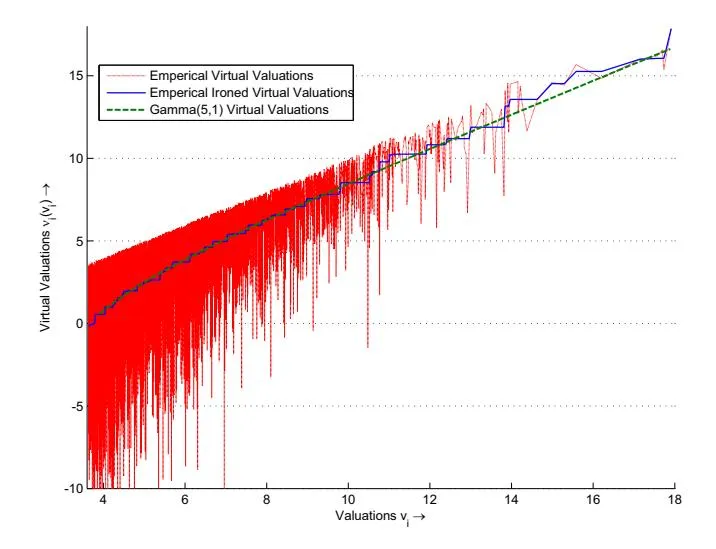

Figure 4: Ironed empirical virtual valuations vs. Gamma(5,1) virtual valuations

independent valuation model and the slotted model. We consider an adword auction model with 4 slots and 6 bidders, i.e. m = 4, n = 6. The click-through-rate matrix is given by

where denotes the expected number of clicks per day when bidder i is assigned to slot j. We take the common random number approach and compare the average performance on a sample of N=10,000 valuation vectors. For each bidder , the synthetic valuations are generated from a gamma distribution with mean 5 and standard deviation , i.e. .

For virtual surplus maximization, we used the virtual valuations defined by the GAMMA(5, 1) distribution5 as well as the virtual valuation implied by the samples. Let denote the value in the t-th position when the samples are sorted in increasing order. Then

Since the empirical virtual valuations is not monotone, we iron it using the ironing procedure in Myerson (1981) to get monotone ironed empirical virtual valuations . From Figure 4 that displays , and in the range of valuation where they are positive it is clear that all these three quantities are very close.

is increasing since Gamma(5,1) is strictly log-concave.

5.1 Results for the uniform slot valuation model

Section titled “5.1 Results for the uniform slot valuation model”As observed in Example 2 computing the optimal expected revenue (efficiency) maximizing rank vectors is not a convex optimization problem and, therefore, cannot be solved efficiently. We circumvent this issue by taking the common random number approach and maximizing the average revenue (or efficiency) over the sampled data. For example, revenue maximizing rank vector

where , denotes the valuation vector for the t-th sample, and denotes the index of bidder ranked at the j-th position in the t-sample. For a given a ranking vector and sample , the slot prices can be computed in time; therefore, one can attempt optimizing the rank vector using a derivative-free NLP method. We use a MATLAB based non-linear optimizer to solve these problems. Since the optimization problem is unconstrained and low dimensional, the MATLAB code is quite stable and converges quickly. The efficiency maximizing rank vector was also computed from the samples.

Table 1 displays the average revenue and efficiency for the following mechanisms.

-

- The revenue maximizing mechanism that uses the sample-based optimal rank vector .

-

- The efficiency maximizing RB that uses the sample-based optimal rank vector .

-

- heuristic RB mechanism: this mechanism uses the Google rank vector for efficiency maximization and Yahoo rank vector (i.e. ) for revenue maximization.

-

- The CRB mechanism: for efficiency maximization the CRB ranks using the valuations and for revenue maximization the CRB ranks using the virtual valuations and .

-

- The optimal mechanism for the true prior GAMMA(5, 1) and the empirical prior distribution.

The superscripts ”*” and “e” denote the revenue maximizing mechanisms and efficiency maximizing mechanism respectively. In the cells corresponding to the CRB and the optimal mechanism in Table 1, the number inside (resp. outside) the bracket denotes the value obtained by using the virtual valuation (resp. ). For the optimal RB mechanisms the revenue and efficiency was computed using the same set of N samples that were used to compute the rank vectors.

The optimal RB achieves 91.95% (92.24%) of the optimal revenue – in contrast, the CRB rule achieves 95.75% (95.71%), thus providing a 3.80% (3.47%) improvement in revenues. Similarly, optimal RB achieves 87.53% of the optimal efficiency and the CRB achieves 93.15% of the optimal efficiency; thus, improving efficiency by 5.62% over the optimal RB.

Table 2 displays the optimal rank vectors, average slot prices and the advertiser’s surplus for optimal RB and heuristic RB under both efficiency maximizing and revenue maximizing mechanisms. These numerical results support the following observations.

a) The efficiency maximizing rank vector is more biased (i.e. away from 1) as compared to the revenue maximizing rank vector. This is consistent with what was observed earlier in Example 2.

| Revenue Maximization | Efficiency Maximization | ||||

|---|---|---|---|---|---|

| Π∗ | Πe | e S | |||

| Heurestic RB | 998.24 | 1523.91 | 938.70 | 1463.47 | |

| Optimal RB | 1020.30 | 1558.90 | 1002.90 | 1571.40 | |

| CRB | 1062.45(1058.62) | 1585.85(1595.81) | 829.36 | 1672.30 | |

| Optimal | 1109.58(1106.08) | 1687.53(1697.96) | 1000.93 | 1795.24 |

Table 1: The revenue and efficiency in RB, CRB and optimal mechanisms

| RB Optimal | RB Heuristic | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| R.M. | E.M. | R.M. | E.M. | ||||||||

| ∗ ∗ ∗ w u p | e w | e u | e p | ∗ u | ∗ p | e u | e p | ||||

| 1 | 1 | 105.19 | 4.5549 | 1 | 110.17 | 4.3125 | 140.09 | 4.3294 | 106.55 | 4.5954 | |

| 2 | 1.1413 | 92.29 | 4.3256 | 1.2949 | 123.12 | 4.1794 | 91.73 | 4.1312 | 67.22 | 4.3611 | |

| 3 | 1.1420 | 80.74 | 3.9090 | 1.0524 | 66.43 | 3.7919 | 68.28 | 3.7273 | 59.22 | 3.9414 | |

| 4 | 0.8196 | 44.65 | 3.5485 | 0.6457 | 24.23 | 3.4902 | 71.54 | 3.4333 | 69.64 | 3.5342 | |

| 5 | 0.9395 | 115.47 | 0.9538 | 126.82 | 32.81 | 131.50 | |||||

| 6 | 1.0462 | 100.24 | 1.1093 | 117.67 | 120.34 | 91.54 |

Table 2: The average slot prices and advertiser surplus in optimal RB and heuristic RB mechanisms

- b) The CRB mechanism tailored for revenue maximization results in higher average prices for each slot and is, therefore, able to extract higher surplus.

- c) The CRB mechanism tailored for efficiency maximization results in in low slot prices and, consequently, low revenues. Thus, it is important that we maximize the virtual surplus when CRB is used for revenue maximization.

- d) The revenue generated by the RB mechanisms when maximizing surplus and virtual surplus is comparable indicating that RB is a robust mechanism.

5.2 Results for slotted model

Section titled “5.2 Results for slotted model”We assumed that the privately known slot value ki ∼ unif{1, … , 4} and generated N = 10000 samples. We used the same set of samples for the valuation as in the previous subsection.

Table 4 displays the average revenue and efficiency with the pointwise maximizer allocation rule and CRB allocation rule. Table 5 displays the average advertiser surplus, average slot prices and average side payments to each bidder. Note that the total average side payment is remarkably low 6.40 (3.3237) when compared to the average revenue. The data in the table together with the bound (26) implies that 988.61+6.40=995.01 (984.9536+3.3237= 988.2763) is an upper bound on the achievable revenue. The pointwise maximizer achieves 99.36% (99.66%) revenue of this bound, while the CRB achieves 94.78% (95.05%) revenue of this upper bound. Thus, both proposed mechanisms are likely to be close to optimal. For efficiency, CRB achieves 92.79% of the true optimal V CG (or pointwise maximizer with νi(vi) = vi) efficiency as shown in Table 4.

| CRB | Optimal | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| R.M. | E.M. | R.M. | E.M. | ||||||

| ∗ ∗ u p | e u | e p | ∗ u | ∗ p | e u | e p | |||

| 1 | 121.93(125.53) | 4.7052(4.6609) | 185.92 | 3.8542 | 115.89(119.26) | 4.4409(4.4139) | 181.92 | 4.1223 | |

| 2 | 61.26(62.58) | 4.3955(4.3441) | 56.19 | 3.3017 | 97.09(99.69) | 4.1567(4.1124) | 114.42 | 3.2994 | |

| 3 | 48.23(46.41) | 3.8203(3.7871) | 30.09 | 2.2039 | 86.80(84.74) | 3.7102(3.6775) | 81.86 | 2.8008 | |

| 4 | 58.45(62.89) | 3.2472(3.2937) | 115.06 | 1.6034 | 51.31(55.22) | 2.9123(2.9355) | 52.82 | 2.9273 | |

| 5 | 130.23(133.05) | 280.58 | 117.65(119.83) | 194.21 | |||||

| 6 | 103.31(106.72) | 175.12 | 109.22(113.14) | 169.08 |

Table 3: The average slot prices and advertiser surplus in CRB and optimal mechanisms

| Revenue Maximization | Efficiency Maximization | ||||

|---|---|---|---|---|---|

| Π∗ | ∗ S | Πe | e S | ||

| Pointwise Maximizer | 988.61 (984.95) | 1468.91(1475.55) | 806.50 | 1562.49 | |

| CRB | 943.11 (939.37) | 1385.20 (1392.49) | 695.64 | 1449.87 |

Table 4: The revenue and efficiency in CRB and optimal mechanisms

Table 5 presents the average side payments, average advertiser surplus and the average slot prices per click for both the mechanisms. The prices tabulated are not adjusted for side payments. This is because side payments could be positive even when no slot is allocated to the advertiser (this happens when at a particular bid profile the advertiser can get a positive allocation by underbidding ki ; however, no slot is allocated at the true ki). We found that the distribution of side payments is very skewed, i.e. even though the average side payments are very small, at certain bid profiles the side payments are of the same order of magnitude as the advertiser surplus.

| Pointwise Maximizer | CRB | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| R.M. | E.M. | R.M. | E.M. | |||||||

| ∗ ∗ ∗ u p u | e u | e p | ∗ u | ∗ p | e u | e p | ||||

| 1 | 97.68(100.15) | 4.9157(4.8965) | 1.7401(0.9592) | 164.73 | 4.6090 | 114.61(118.04) | 5.0799(5.0405) | 196.07 | 4.2767 | |

| 2 | 78.55(80.70) | 4.3183(4.2910) | 0.8961(0.6066) | 101.03 | 3.4710 | 61.77(63.17) | 4.243(4.2082) | 73.19 | 3.0186 | |

| 3 | 66.60(65.06) | 3.1226(3.1033) | 0.6893(0.5558) | 69.42 | 1.6009 | 48.47(46.51) | 2.7492(2.7484) | 46.36 | 1.1265 | |

| 4 | 37.36(39.61) | 1.0297(1.0457) | 0.4743(0.1776) | 58.29 | 0.2571 | 35.84(38.51) | 1.0054(1.0260) | 71.52 | 0.0888 | |

| 5 | 101.78(103.31) | 1.6600(0.5830) | 195.57 | 97.02(99.04) | 207.09 | |||||

| 6 | 91.93(95.12) | 0.9417(0.4405) | 166.95 | 84.38(87.86) | 160.00 |

Table 5: The average slot prices and advertiser surplus in CRB and optimal mechanisms in the slotted mechanism

6 Conclusion

Section titled “6 Conclusion”The discrete structure of the adword auction allocation space allows us to reduce the IC constraint to the existence of bidder dependent slot prices at which each bidder self-selects their allocated slot. We use this new characterization to show that in this auction models there are IC mechanisms which are not affine maximizers. Achieving optimal revenues with multi-dimensional types in this model remains a hard stochastic program involving multi-dimensional ironing and sweeping.

In slot independent private valuation model, the pricing characterization collapses to the existence of ordered threshold at which a given advertiser is allocated particular slots. The prices implementing any IC allocation rule can by computed very efficiently. When the click through rate is not separable, we show that the revenue (efficiency) maximizing rank vector can be efficiently computed using the history of bids available for each adword. When prior information is unavailable, the proposed CRB allocation rule is a very attractive choice since it is simple, non-parametric, computationally efficient and has a superior performance to any rank based mechanism. Our numerical study also indicate that both RB and CRB achieve close to optimal revenues and efficiency without using detailed prior information.

In the slotted auction model even though the set of IC mechanism is easy to characterize, computing the optimal mechanism problem is a hard because of the non-zero side payments needed to screen the slot information. Our numerical study indicates that the two sub-optimal mechanisms proposed in this paper are likely to perform close to optimal.

References

Section titled “References”-

Aggarwal, G., Feldman, J., and Muthukrishnan, S. (2006a). Bidding to the top: Vcg and equilibria of position-based auctions. Working Paper.

-

Aggarwal, G., Goel, A., and Motvani, R. (2006b). Truthful auctions for pricing search keywords. In Proceedings of the 2006 ACM Conference on Electronic Commerce, Ann Arbor, MI.

-

Ahuja, R. K., Magnanti, T., and Orlin, J. (1993). Network Flows: Theory, Algorithms and Applications. Prentice Hall, NJ.

-

Bikhchandani, S. and Ostroy, J. M. (2006). From the assignment model to combinatorial auctions. In Peter Cramton, Y. S. and Steinberg, R., editors, Combinatorial Auctions. MIT Press, Cambridge, MA.

-

Chung, K.-S. and Ely, J. C. (2002). Ex-post incentive compatible mechanisms. Working Paper, Department of Economics, Northwestern University.

-

Edelman, B., Ostrovsky, M., and Schwarz, M. (2005). Internet advertising and the generalized second price auction: Selling billions of dollars worth of keywords. NBER Working paper 11765.

-

Feng, J. (2006a). Optimal mechanism for selling a set of commonly ranked objects. Working Paper.

-

Feng, J. (2006b). Price cycles in online advertising auctions. Working Paper.

-

Feng, J., Bhargava, H. K., and Pennock, D. M. (2005). Implementing sponsored search in web search engines: Computational evaluation of alternative mechanisms. Fothcoming in Informs Journal on Computing.

-

Groves, T. (1979). Efficient collective choice with compensation. In Laffont, J.-J., editor, Aggregation and Revelation of Preferences, pages 37–59. Amsterdam: North-Holland.

-

Hongwei, G., Muller, R., and Vohra, R. V. (2004). Dominant strategy mechanisms with multidimensional types. Working Paper.

-

Iyengar, G. and Kumar, A. (2006). Optimal procurement auctions for divisible goods with capacitated suppliers. Technical report. CORC Tech Report - TR-2006-01, Available at http://www.corc.ieor.columbia.edu/reports/techreports/tr-2006-01.pdf.

-

Kitts, B., Laxminarayan, P., LeBlanc, B., and Meech, R. (2005). A formal analysis of search auctions including predictions on click fraud and bidding tactics. In Workshop on Sponsored Search Auctions, ACM Electronic Commerce, Vancouver, British Columbia, Canada.

-

Lahaie, S. (2006). An analysis of alternative slot auction designs for sponsored search. In Proceedings of the 2006 ACM Conference on Electronic Commerce, Ann Arbor, MI.

-

Lavi, R., Mu’alem, A., and Nisan, N. (2004). Towards a characterization of truthful combinatorial auctions. Working Paper.

-

Leonard, H. (1983). Elicitation of honest preferences for the assignment of individuals to positions. Journal of Political Economy, 91(3).

-

Lim, W. S. and Tang, C. S. (2004). An auction model arising from an internet search service provider. Fothcoming in European Journal of Operations Research.

-

Liu, D. and Chen, J. (2005). Designing online auctions with past performance information. Working Paper.

-

Milgrom, P. R. (2004). Putting Auction Theory to Work. Cambridge University Press, Cambridge, UK.

-

Myerson, R. B. (1981). Optimal auction design. Mathematics of Operations Research, 6(1):58–73.

-

Roberts, K. (1979). The characterization of implementable choice rules. In Laffont, J.-J., editor, Aggregation and Revelation of Preferences, pages 321–348. Amsterdam: North-Holland.

-

Rochet, J. C. (1987). A condition for rationalizability in a quasi-linear context. Journal of Mathematical Economics, 16:191–200.

-

Rochet, J.-C. and Chone, P. (1998). Ironing, sweeping, and multidimensional screening. Econometrica, (4):783–826.

-

Saks, M. and Yu, L. (2005). Weak monotonicity suffices for truthfulness on convex domains. Working Paper, Available at http://www.math.rutgers.edu/~saks/PUBS/truthful.ecsub.pdf.

-

Shapley, L. and Shubik, M. (1972). The assignment game-I: the core. Inter-national Journal of Game Theory, 1:111–130.

-

Varian, H. R. (2006). Position auctions. working paper.

-

Vohra, R. V. and Malakhov, A. (2005). Optimal auction for capacitated bidders - a network approach. Working Paper, Managerial Economics and Decision Sciences, Kellogg School of Management, Northwestern University.

-

Zhan, R. L., Shen, Z.-J. M., and Fengz, J. (2005). Ranked items auctions and online advertisement. Working Paper.